Vegas Odds On State Electoral Votes. Betting on which direction a state will vote has become a part of the political betting lines available on the 2020 presidential election. Some sportsbooks provide odds on every single state, while others may only include toss up or swing states. While swing states in past elections can be determined simply by looking at how close the vote was in each state, determining states likely to be swing states in future elections requires estimation and projection based on previous election results, opinion polling, political trends, recent developments since the previous election, and any.

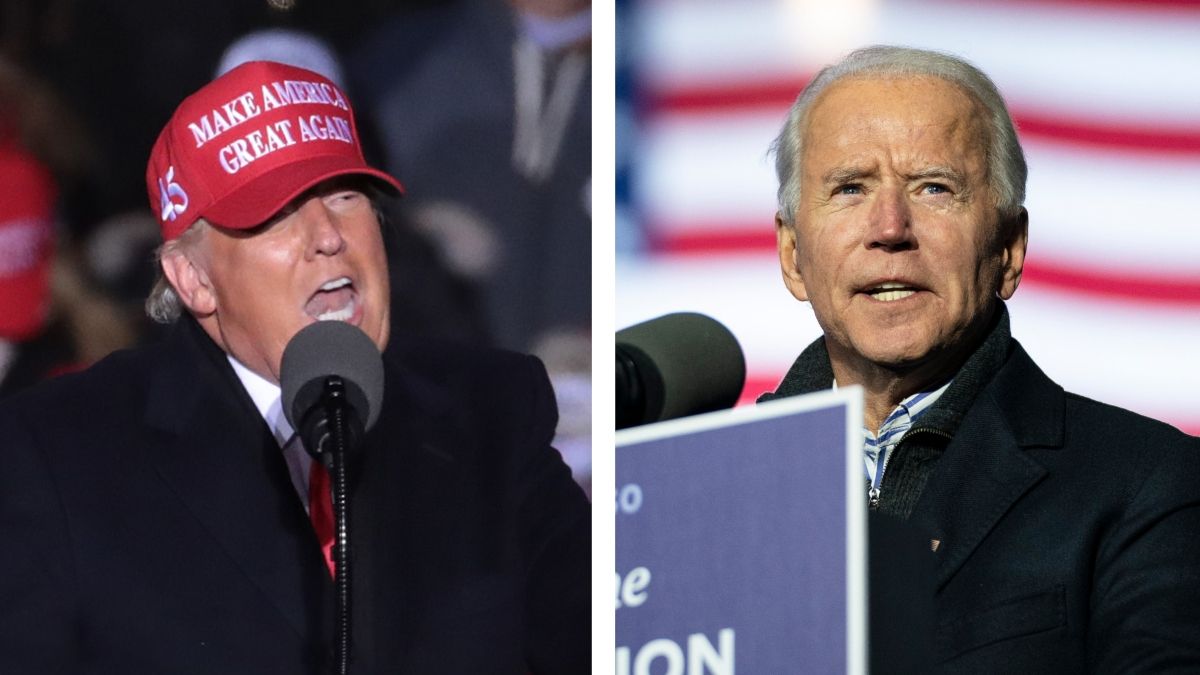

© ShutterstockS&P 500 may lead Nikkei 225 Higher as Biden Wins Key Swing States

US equity futures climbed as Biden took Michigan - a key swing state. Rising odds of a Democratic presidency boosted sentiment. The Nikkei 225 index look set to trade higher following strong US leads.

US ELECTION, S&P 500, Nikkei 225 OUTLOOK:

US stocks were in ‘risk-on’ mode as election results leaned to a Biden-win, divided Congress The British Pound fell ahead of BoE meeting, as traders anticipated further easing measuresNikkei 225 index may trade higher, setting a positive tone for Asia-Pacific stocksUS election, S&P 500 Index and Asia-Pacific markets:

All three major US indices soared on Wednesday as the odds swung to favor Joe Biden after he took Michigan - a key swing state. Biden has likely pocketed 264 out of the 270 electoral votes that are required to win the election. Traders are eyeing the vote counts in Nevada, which has 6 electoral votes, for the final results. Nasdaq, S&P 500 and Dow Jones rallied 3.85%, 2.20% and 1.34% respectively overnight.

Risk assets were in a rally mode, with equity futures across the Asia-Pacific posit to open broadly higher. The haven-linked US Dollar fell alongside the VIX volatility index. Crude oil prices rose for a third day on a weaker US Dollar, falling stockpiles and hope that Russia and OPEC+ may rein production. The British Pound was among the worst-performing G10 currencies today as market anticipated further easing measures to be announced in the BoE meeting later today.

2020 US election results

© ZUUonline SGThe US has registered 92,660 new coronavirus cases on November 3rd, marking the third highest daily count behind October 30th. Market focus will likely shift back to the fundamental elements and how the government plan to handle the second pandemic wave after the election. More monetary and fiscal support might be needed to weather through this crisis. Friday’s FOMC meeting and US non-farm payroll data are critical to watch out for.

On the macro front, BoE interest rate decision and US weekly jobless claims are among the top events besides the US election results. Find out more on our economic calendar.

Sector-wise, last night saw a fairly balanced sectoral pattern, with 46.7% of the index’s constituent ending higher. Healthcare (+4.45%), communication services (+4.25%) and information technology (+3.83%) were doing the heavy-lifting, whereas materials (-1.65%) and utilities (-1.60%) were lagging behind.

S&P 500 Index Sector Performance 04-11-2020

© ZUUonline SG

© ZUUonline SGTechnically, the S&P 500 index rebounded with strong upward momentum this week. An immediate resistance level can be found at 3,470 - the 23.6% Fibonacci retracement (chart below). Failing to break this level may result in a pullback with an eye on the 20- and 50-Day Simple Moving Average (SMA) lines as immediate support levels. In the medium term, the S&P 500 index’ bull trend appears to remains intact. Holding above the 100-Day SMA may pave way for more upside potential.

S&P 500 Index - Daily Chart

© ZUUonline SG

Nikkei 225 Index Outlook:

Technically, the Nikkei 225 index has rebounded after entering into a period of consolidation last week. The index attempt to break the upper ceiling of the “Rising Wedge” (chart below) that formed since June. 24,000 also serves as a key resistance level as the index has failed three times to break it from December 2019 to February 2020. The overall trend remains bullish-biased.

Nikkei 225 Index - Daily Chart

© ZUUonline SGThis commentary is kindly contributed by Margaret Yang, DailyFX Strategist

Graphics by Ryan Best

It’s the holy grail of presidential election campaigns: knowing which states will be decisive in the Electoral College. We have our guesses: States like Arizona, Michigan, North Carolina and Wisconsin are widely expected to be among the top swing states for 2020. But how confident can we really be in those expectations five months before the election?

To find out, we went back and checked which states election handicapper The Cook Political Report thought would be swing states as of mid-June 2004, 2008, 2012 and 2016. We then compared those early ratings to what the actual swing states turned out to be after the election. (To be clear, Cook does great work, and we’re not trying to pick on them — we’re simply using them as a proxy to see where conventional wisdom stood at the time. It’s actually surprisingly hard to find historical sources for this, and Cook is one of the only outlets we could consistently find with early assessments of the presidential race dating back to 2004. In an email, Charlie Cook, the founder of The Cook Political Report, told us he thinks of its ratings as rough guidelines, particularly at this point in the cycle: “My view has always been that we are not trying to predict outcomes as much as help our readers see which states are safely in a party’s column, which aren’t but could get into play, which ones are competitive but one side seems to have an advantage, and which ones are really, really close.”)

Importantly, much of how accurate these early ratings are hinges on how you define what is a swing state. For instance, “swing state” could mean simply a state that is closely contested — a toss-up state in Cook’s lingo. But it could also mean a bellwether state — aka a state whose results closely match the national popular vote. This might sound like semantics, but it’s actually an important distinction: In a roughly tied election, toss-up states and bellwether states are more or less the same; however, in an election in which, say, one candidate leads nationally by 10 points, the bellwether states may not actually be very close. So how you define a swing state matters.

And as it turns out, early ratings are often wrong about which states will be toss-ups in November. But, as we will explain, that doesn’t mean they are useless or even bad. In fact, Cook does have a pretty good track record of identifying an election’s bellwether states early on, and arguably that’s more important.

First, though, let’s look at which states Cook expected would be toss-ups at this point in the cycle in the last four presidential elections and which states actually ended up being toss-ups.Expected toss-ups were those that Cook rated as toss-ups as of mid-June. However, since Cook does not actually define what makes a state a toss-up, we made up our own definition for which states were toss-ups after the election. For our purposes, these are states decided by a margin of 5 points or fewer.

'>1 The teal states in the chart below are those that Cook correctly rated as toss-ups; the pink ones are states that Cook rated as toss-ups but did not turn out to be that close; and the gray ones are states that Cook did not rate as toss-ups but ended up close enough to count as one.

As you can see, Cook’s record of calling toss-ups is mixed. In June 2008, Ohio was the only toss-up state it called correctly. In late May 2016, it correctly identified New Hampshire and North Carolina as toss-ups but missed nine other states that turned out to be tight. On the bright side, in April 2004,As far as we could tell, these ratings were still operative in mid-June 2004.

'> 2 Cook correctly foresaw seven states’ toss-up status, missing only four and incorrectly calling toss-ups in just Florida and Missouri. And in late May 2012, it correctly pegged all four of the eventual toss-up states; while at first glance it appears they cast too wide a net by also rating Colorado, Iowa, Nevada, New Hampshire and Pennsylvania as toss-ups, those states all just barely missed the cutoff for being actual toss-ups (then-President Barack Obama won them each by 5 to 7 points).

2 Cook correctly foresaw seven states’ toss-up status, missing only four and incorrectly calling toss-ups in just Florida and Missouri. And in late May 2012, it correctly pegged all four of the eventual toss-up states; while at first glance it appears they cast too wide a net by also rating Colorado, Iowa, Nevada, New Hampshire and Pennsylvania as toss-ups, those states all just barely missed the cutoff for being actual toss-ups (then-President Barack Obama won them each by 5 to 7 points).

But what went wrong in 2008 and 2016 wasn’t that Cook misread the electorate in specific states; it’s that it didn’t realize how competitive (or uncompetitive) the presidential race would be overall. (To be clear, this is not Cook’s fault; there was no way for anyone to anticipate that the economy would collapse in fall 2008, sending Obama to a landslide victory, or that then-FBI Director James Comey’s Oct. 28 letter to Congress seemed to bring the 2016 campaign within a normal-sized polling error of a Donald Trump victory.)

This is clear when you look at the states that Cook’s springtime ratings implied would be bellwethers: Most of them turned out to be actual bellwethers in November.Cook doesn’t directly peg states as bellwethers the way they do toss-ups, but which states they think are bellwethers can be inferred from the states that have the same race rating as the median electoral vote. For example, in 2016, Cook’s expected bellwethers were the seven “Lean D” states because the states to their left combined for 201 electoral votes and the states to their right combined for 234. And how the “Lean D” states voted determined which side got 270 electoral votes. As for which states we considered bellwethers after the election, we judged a state to be a bellwether if the final margin there was within 5 points of the national popular vote margin.

'>3Swing State Betting Odds

In late May 2016, Cook was wrong to think former Secretary of State Hillary Clinton was an overall favorite, but it did correctly anticipate that Colorado, Florida, Michigan, Nevada, Pennsylvania, Virginia and Wisconsin would closely mirror the national popular vote (although three other states also did). Similarly, in June 2008, Cook’s ratings implied a presidential race that was too close to call, but even after the race shifted in Democrats’ favor, four of the six states Cook viewed as the likeliest bellwethers indeed turned out to be bellwethers (although so did four other states Cook missed). And in 2004 and 2012, Cook had even more success pre-identifying bellwether states than they did pre-identifying toss-up states.

So where does that leave us in 2020? Well, as of June 16,Although the ratings were last updated on March 9.

'>4 The Cook Political Report lists six statesPlus the Nebraska 2nd District; Nebraska is one of two states that splits its electoral votes by congressional district.'>5 as toss-ups: Arizona, Florida, Michigan, North Carolina, Pennsylvania and Wisconsin. And since Democrats have the advantage in states worth only 232 electoral votes and Republicans have the advantage in states worth only 204, Cook is therefore also expecting these six states to be bellwethers.History suggests you can largely trust those bellwether ratings, too — though you should expect the election to still throw us a few curveballs. One or two of those states will probably not be that close to the national popular vote; two or three states not on this list probably will turn out to be good national bellwethers.

Swing State Odds Game

The toss-up ratings, on the other hand, should not be taken literally — at least not at this stage. And that’s because, while handicappers are pretty good at assessing how states will vote in relation to one another, it is more challenging to forecast the national political environment so far in advance. But in a way, that’s OK; the bellwethers are really what matter.

It doesn’t really matter if, say, Virginia or Texas is decided by just 1 point, because if either one of those scenarios comes to pass, the election is likely a landslide. Knowing the bellwethers in advance is arguably far more valuable because we can then focus our energy on watching who is leading in them — because whoever wins the bellwethers wins the election.